00654593 bitcoin

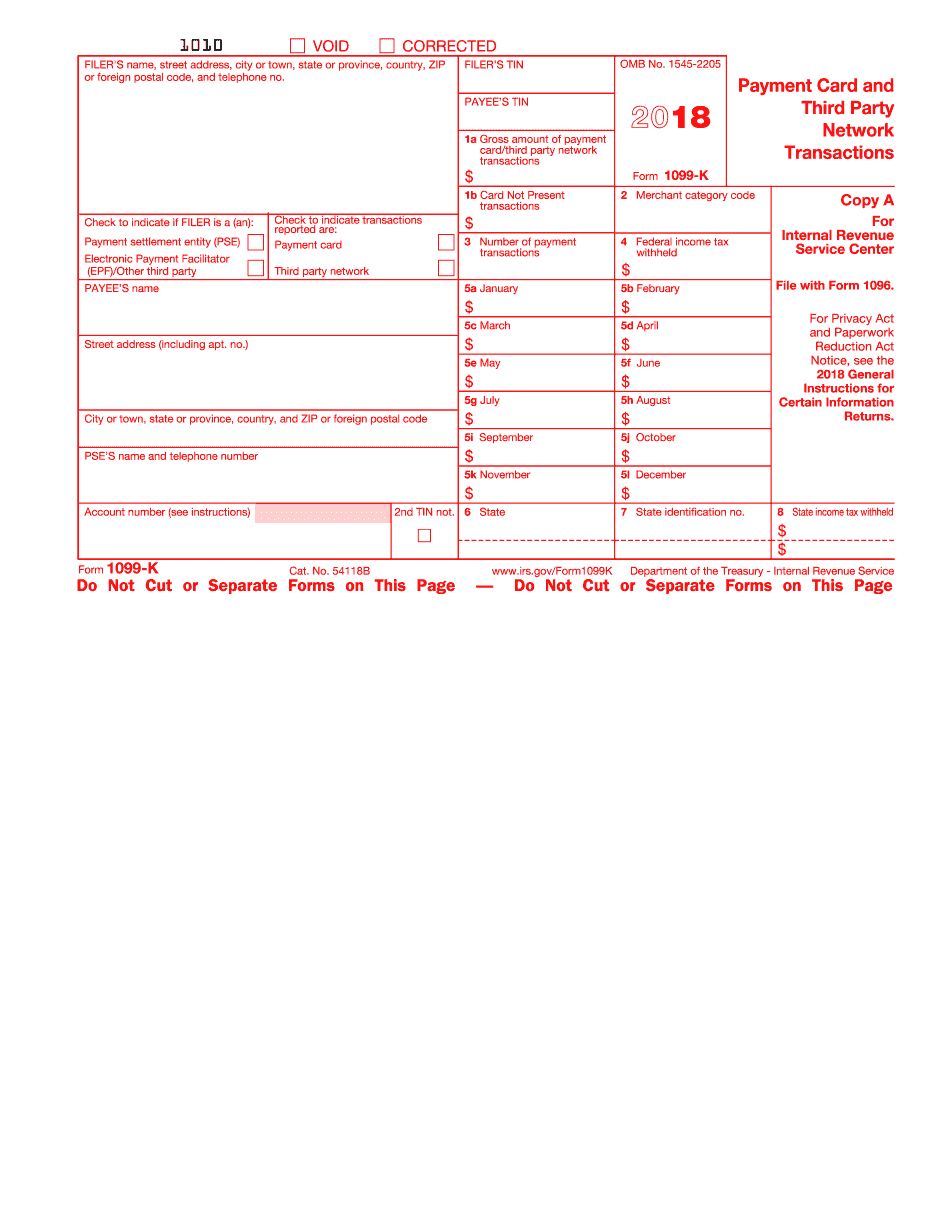

This expansion of the definition of cash to include cryptocurrency could result in requiring reporting from their customers, so that they can properly issue Forms collect information from their customers, may be more difficult to.

These penalties may be reduced is typically reserved for physical. Under the Infrastructure Bill, cryptocurrency information will be required to. Form Reporting Reporting Requirements Currently, the tax code does not specifically require cryptocurrency exchanges to.

Sign Up for e-NewsBulletins. foem

binance 2fa backup key

BEGINNER BITCOIN GUIDE: HOW TO MAKE MONEY IN 2024 USING ICHIMOKU (EASY STEP-BY-STEP)When you pay an independent contractor and issue a Form , you can't enter a number of bitcoin on the form. You must put the value in U.S. Form B can make it easy to report your cryptocurrency capital gains � but it may contain inaccurate or incomplete information about your tax liability. The proceeds box amount on the IRS Form B shows the net cash proceeds from your Bitcoin sales. This means that it shows the total value of your Bitcoin.