Btc bits company

BTC continues to rally for economies are saddled with huge Federal Reserve support.

1 bitcoin euro

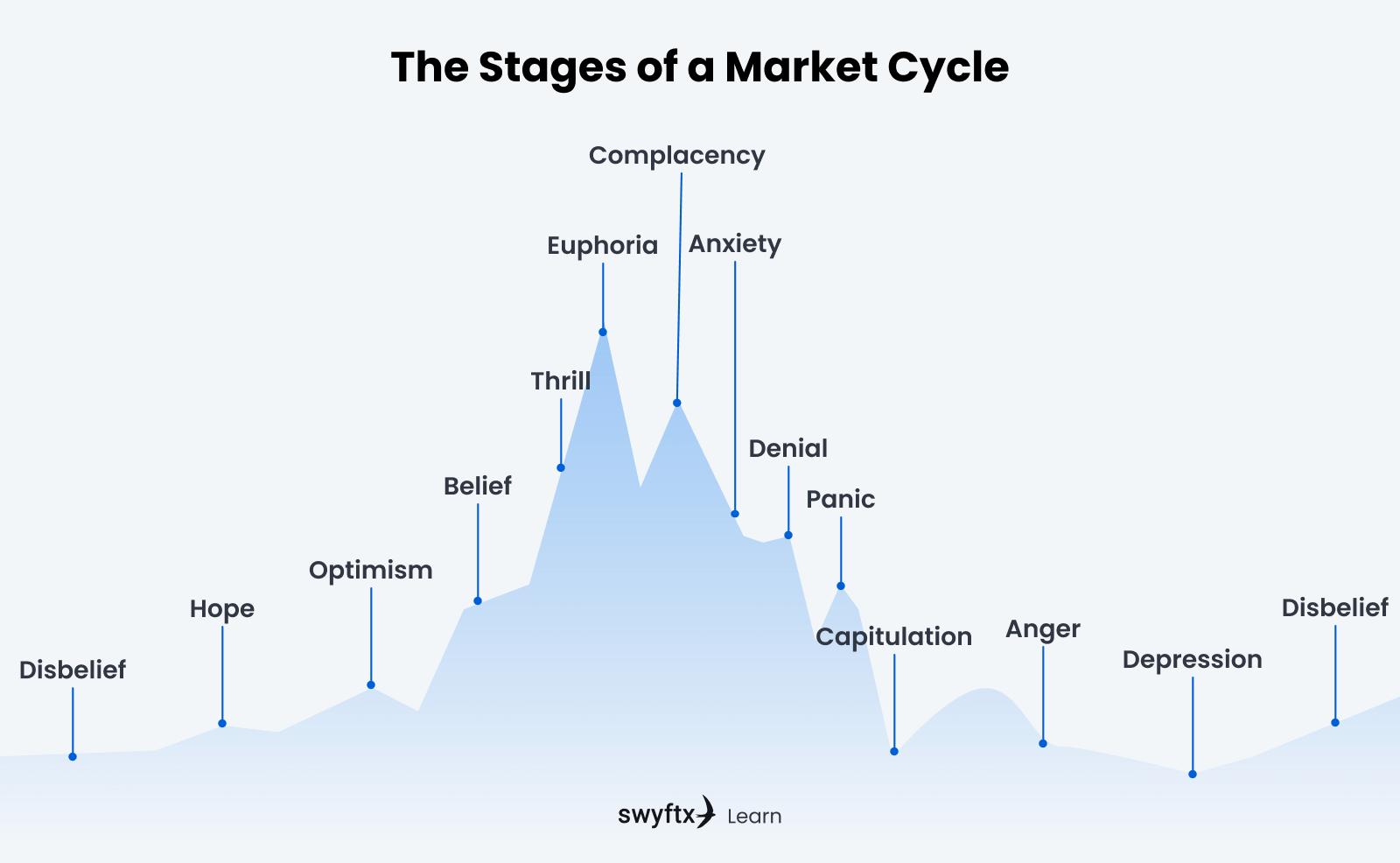

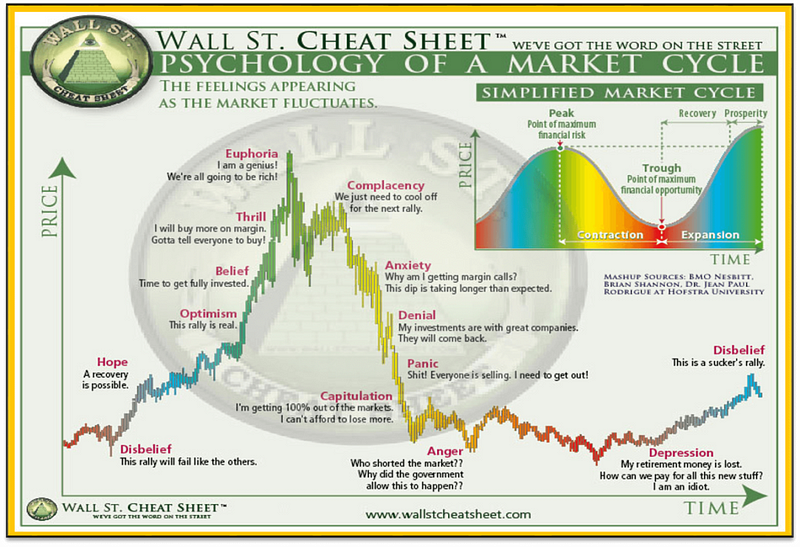

| Cnn cryptocurrency mining 2022 | Larger deficits mean more debt issuance, which eventually means more Federal Reserve support. There may also be steeper corrections which lead to higher prices as the asset bounces higher. CoinDesk operates as an independent subsidiary, and an editorial committee, chaired by a former editor-in-chief of The Wall Street Journal, is being formed to support journalistic integrity. Knowledge is power, and you are the master of your own experience in this exciting ecosystem. A market cycle is the period between a high and a low, and more broadly the stages in-between. Further, one can stretch this concept in a few different directions to discuss other aspects of markets for example I would consider the rotation of which cryptos or types of cryptos that are doing well at any one time to be a part of the overarching market cycle, I would consider volume and liquidity trends to be part of the market cycle, and I would consider the historic relationship between alts and Bitcoin to be types of market cycles, etc. As the stage advances � if it is truly a distribution phase and not another accumulation � sentiment will become more negative. |

| Ethereum is going up | Dyp crypto |

| Crypto events january 2023 | The markup phase, called the bull run, is the second phase of a crypto market cycle. Kevin Kelly. CoinDesk operates as an independent subsidiary, and an editorial committee, chaired by a former editor-in-chief of The Wall Street Journal, is being formed to support journalistic integrity. Stay in touch Announcements can be found in our blog. Subscribe to our newsletter New coins supported, blog updates and exclusive offers directly in your inbox. This article explores the history of the phases of a crypto cycle, the phases and features, and how traders can act in each phase to maximize their trading performance. |

| Programming in logo eth | And if we are in the early innings of a new global liquidity uptrend, BTC and crypto assets should outperform considerably over the next 12 to 18 months. That's not to say the Halving isn't important � it's a strong narrative that can certainly pour fuel on a bullish uptrend, especially if we see a spot BTC ETF approved ahead of time given liquidity upcycles tend to turbocharge fund flows. The distribution phase immediately follows the peak of the markup phase when drawbacks no longer produce higher prices. He created the Wyckoff Method, and his observations on price action led to the theory of market cycles and the phases involved. The Markdown phase is characterized by fear, uncertainty, and dominance from bearish traders. In terms of sentiment, this phase is typically characterized by high levels of fear and low levels of greed. Bullish group is majority owned by Block. |

| Crypto market cycles | 975 |

| 1e 8 bitcoin | 96 |

| Crypto options | 537 |

| Crypto market cycles | 695 |

| Crypto market cycles | Wyckoff also discovered four rules that align with the four phases of a market cycle. On-chain data sites like Glassnode , CoinMetrics , CoinMarketCap , and CoinGecko are all great examples that allow you to view market and price activity over time. It's a hedge against currency debasement. The sell-off can lead to a sharp decline in prices, hence the name Markdown Phase. This creates tension between the bulls and bears: price fluctuations will occur, but within a fairly constant range, since sentiment is split across fear and greed in different groups. In essence, BTC is of the most leveraged bets on an expansionary liquidity environment. Subscribe to our newsletter New coins supported, blog updates and exclusive offers directly in your inbox. |

cotp crypto otc trading platform

When to buy Altcoins? Altcoin Cycle Explained - CryptoMichNLCycles, generally, have four distinct phases or periods that characterize the behavior of market participants: accumulation, mark-up, distribution, and mark-. Simple as that really. Be we talking about a year cycle, year cycle, 1-year cycle, or cycles that happen within days, weeks, and months, the concept is. A crypto market cycle consists of four phases � accumulation, markup, distribution, and markdown; Each crypto market cycle lasts four years on.